Once your EI benefit periods has ended you must wait for the current CRB period to end before you can apply. However you should consult your regional support program to find out if CERBCRB has any affect to your provincial benefits.

Who Is Eligible To Apply For The Crb The Benefits

You had a 50 reduction in your average weekly income compared to the previous year due to COVID-19.

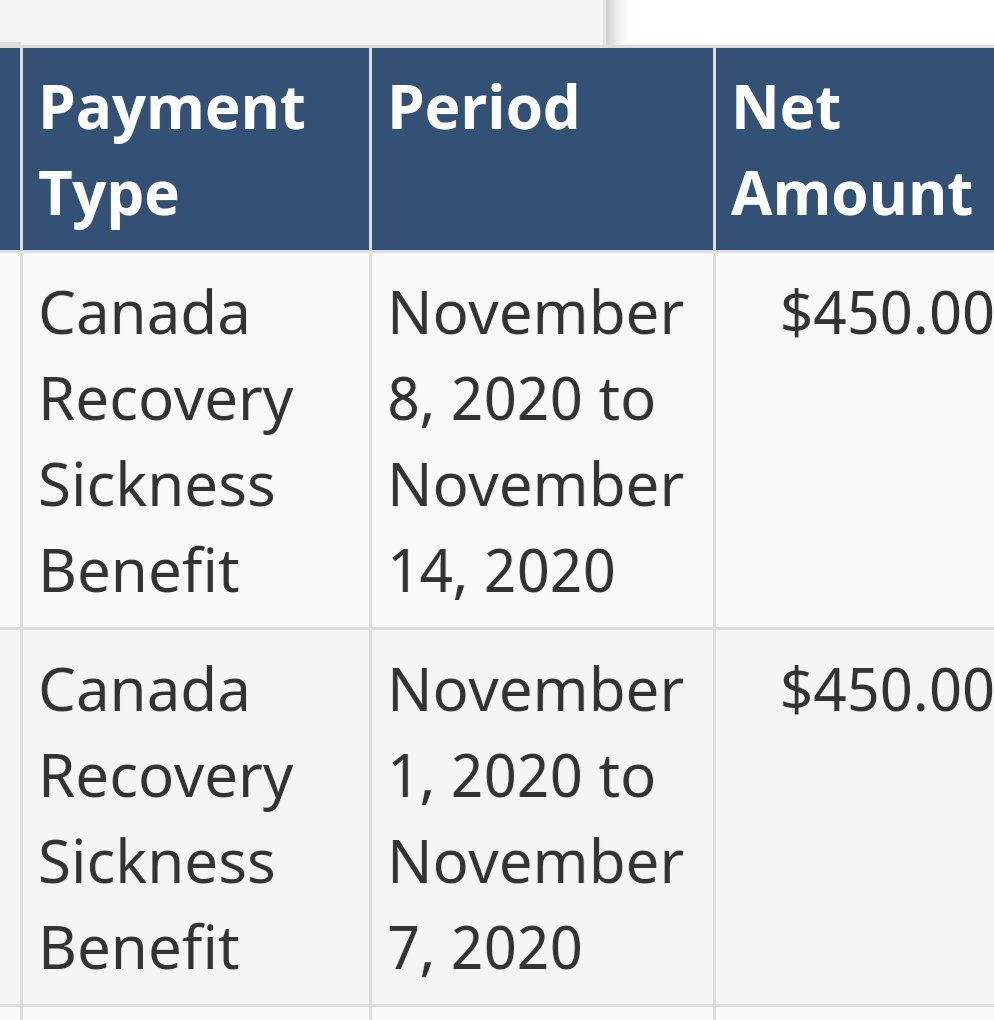

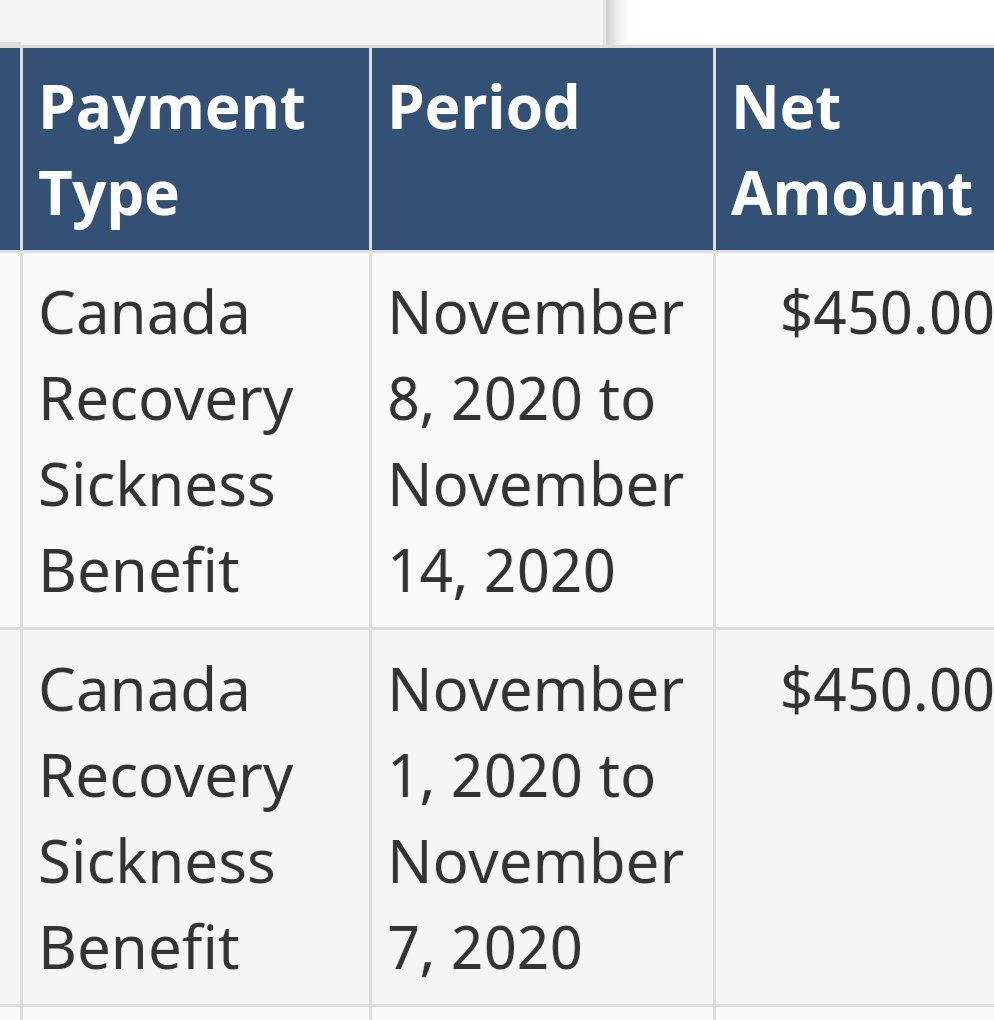

Crb benefits eligibility. CERBCRB payments will have to be reported to CRA in your 2020. Each Canada Recovery Benefit CRB eligibility period is a specific 2-week period. In general you must actively seek employment to remain eligible.

You may earn employment or self-employment income while you receive the CRB. The CRB will remain available to people who are unable to work or have had at least a 50 per cent reduction in average weekly income due to COVID-19. Each Canada Recovery Benefit CRB eligibility period is a specific 2-week period.

During the period youre applying for. You may apply for up to a total of 27 eligibility periods 54 weeks between September 27 2020 and October 23 2021. This includes most people who are.

Although the Canada Recovery Benefit payments end September 25 2021 the government is proposing an extension if public health measures apply. Theyve changed the requirements for EI eligibility to make it easier for more people to qualify. This amount excludes CRB payments.

You must meet the CRB eligibility criteria to apply. Canada Recovery Benefits CRB FAQ update. When you apply you will receive a 1000 900 after taxes withheld payment for the period that you applied for.

To be eligible for the Benefit you must be available and looking for work and must accept work when it is reasonable to do so. Since there still seems to be some confusion around eligibility and loads of questions still being asked about whether people should apply for EI or CRB I wanted to clarify that this isnt a choice. It is for people who do not qualify for Employment Insurance EI.

If you are eligible for the Canada Recovery Benefit CRB you can either receive 1000 900 after taxes withheld or 600 540 after taxes withheld for a 2-week period depending on when you start applying for the benefit. Working while receiving CRB. By increasing the number of weeks available under the CRB EI claimants who have exhausted the maximum 50 weeks of EI regular benefits would need to apply for the four additional weeks of the CRB provided they meet the eligibility.

You will receive a T4A from Canada. Additional Canada Recovery Benefit CRB eligibility rules Canadian residents have to be in the country for the CRB claim period. Self-employed or independent contractors sometimes called gig workers.

You may receive 600 540 after taxes withheld for a 2-week period. Applicants must be at least 15 years old with a valid Social. CRB - Analysen für Geschäftsbetriebe und private Kunden.

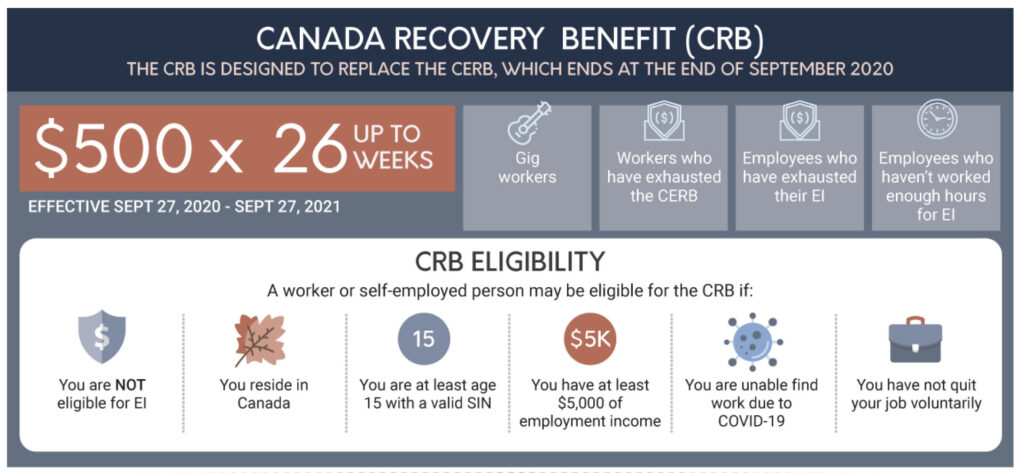

It will provide a benefit amount of 500 per week available in two-week periods for up to 26 weeks for those who have stopped working and who are not eligible for EI. Canada Recovery Benefit The new Canada Recovery Benefit will be effective from September 27 2020 to September 25 2021. You did not apply for or receive any of the following.

New CRB Benefit through Canada Revenue Agency - Eligibility. You reside and were in Canada. Canada Recovery Benefit CRB.

The CRB does not renew automatically. Rufen Sie uns an. To be eligible for the CRB you must meet all the following conditions for the 2-week period you are applying for.

Ad CRB bietet Ihnen einen breites Spektrum von Verfahren zur Feststoffanalytik. Depending on when you start applying for the CRB you can either receive 1000 900 after taxes withheld or 600 540 after taxes withheld for a 2-week period. You are not eligible for Employment Insurance.

Your gross income last year was at least 5000 or your income was 5000 within the 12 month period before applying for CRB this income can include employment self employment and maternitypaternity benefits. Payments from Employment. But to make sure the benefit reaches those who need it most the CRB has an income threshold of 38000 CAD.

Ad CRB bietet Ihnen einen breites Spektrum von Verfahren zur Feststoffanalytik. This temporary benefit provides 500 per week taxable for up to 42 weeks between September 27 2020 and September 25 2021. Depending on when you start applying for the benefit you can either receive 1000 900 after taxes withheld or 600 540 after taxes withheld for a 2-week period.

How eligibility periods work. You only apply for CRB if you dont qualify for EI. How eligibility periods work.

CERBCRB payments will have to be reported to CRA in your 2020 income tax. You can continue to re-apply for the CRB for a period of up to 50 weeks or 25 eligibility periods anywhere between September 27 2020 and September 25 2021. For the CRSB sickness benefit a medical certificate is not required to qualify for the benefit.

You will have to reimburse 050 CAD for every dollar of net income you earn above 38000 CAD on your income tax return for. CERB and CRB are not considered as employment or self-employed income therefore you do not have to report these benefits under your CPP Disability benefit. During each CRB benefit application CRA will require you to attest that you continue to meet the eligibility requirements.

The first day that you can get CRB money for is September 27. If they approve the extension you can apply for the CRB up to October 23 2021. Students who were getting the Canada Emergency Student Benefit CESB have many questions about whether they qualify for the new CRB Canada Recovery Benefit.

Here are a few of the key changes that will apply to new claims for benefits made beginning Sept. The Canada Emergency Rent Subsidy CERS the. You were not working for reasons related to COVID-19.

If your situation continues you will need to apply again. Eligibility for an Enhanced DBS Check may also be determined by the applicants place of work. Youre at least 15 years old or older.

The Canadian government created the Canada Recovery Benefit CRB to replace the Canada Emergency Response Benefit CERB. The federal government is reminding Canadians who are no longer eligible for Employment Insurance EI benefits that they may qualify for the Canada Recovery Benefit CRBAs of September 12 2021 EI claimants who have used up all of their weeks of regular benefits may be able to receive the CRB provided they meet the eligibility criteria. You will need to have missed at least 60 of your weekly duties due to sickness from COVID-19 or self-isolation.

CRB - Analysen für Geschäftsbetriebe und private Kunden. Rufen Sie uns an.

Crb Q A Your Crb Questions Answered Vol 1 Crb And Students Youtube

Canada Recovery Benefit Crb Explained Youtube

Who Qualifies For The Canada Recovery Benefit Crb Steps To Justice

When Can You Apply For Your First Crb Payment The Benefits

Professional Accountants Ottawa Accounting Bookkeeping Ottawa

Crb Crsb What You Need To Know Davies Financial

Canada Recovery Benefit Crb Settlement Calgary

Canada Recovery Benefit Crb 500 Week Up To 26 Weeks Accounting Plus Financial Services

Who Is Eligible To Apply For The Crb The Benefits

Dbs Or Crb What Is The Difference Aaron S Department

Canada Recovery Benefit Consolidated Credit Canada

Canada Revenue Agency On Twitter Hi Each Crb Eligibility Period Is A Specific 2 Week Period Period 4 Is From November 8 To November 21 2020 And Is Open For Application If You

Canada Recovery Benefit Crb Open Application Fulcrum Group

ConversionConversion EmoticonEmoticon